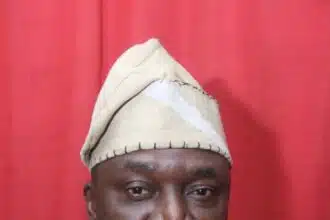

Senator Adams Oshiomhole has called for stricter oversight of financial institutions operating outside the traditional banking system, citing his own encounter with cyber fraud involving fintech platforms.

Speaking during Thursday’s plenary session, the Edo North senator urged the National Assembly to closely examine and pass a bill seeking to amend the Banks and Other Financial Institutions Act. The bill aims to designate, register, and enhance supervision of systemically important institutions, including non-bank financial operators.

Oshiomhole stressed that the Senate must ensure all possible loopholes are blocked, particularly as digital financial platforms expand beyond conventional regulatory reach.

He drew from personal experience, stating, “When they hacked into my account, I found that all the institutions used were OPAY and Moneypoint; none of the registered banks were used.”

He expressed concern that such platforms often lack physical presence, traditional employment structures, and social accountability.

“They don’t have a branch in Abuja. They don’t employ labour. They bear no social responsibility,” Oshiomhole added.

The bill, which has passed second reading, seeks to empower the Central Bank of Nigeria to supervise institutions whose failure could pose significant risk to the financial system.